How a Customer Data Platform can be revolutionary for Insurers

In today's digital-first world, Insurance players need to have reliable data to make not only policy and underwriting decisions, but to ensure tailored digital experiences for their customers.

In this article, we examine how a Customer Data Platform (CDP) can deliver a single source of the truth from diverse data sources and how this can be a game-changer for the Insurance Industry.

Understanding what a CDP is

Simply put, the purpose of a CDP is to coalesce all customer data, make sense of that data, to create unified customer profiles. From there, you can personalise digital experiences that will resonate with customers.

In a previous article, it was noted: "[A] CDP unifies and centralises disparate customer data, making it available in real-time for segmentation, campaign automation and personalisation. By using an intuitive user interface, segments and cross-channel campaigns can be created without reliance on IT."

As people are now using digital channels as their primary means to interact with companies, including insurers, a CDP gives a unified 360° view of the customer – their wants, likes, habits and transactions.

Furthermore, as David Rabb, from the CDP Institute, points out: "[Today's consumers] simply assume that your company knows – and remembers – who they are, what they've done, and what they want, at all times and across all channels."

How does a CDP work?

The best way to gain advantage over your competitors is to deliver highly targeted, intent-based content and messaging.

To personalise experiences for the customer, the marketing and operational systems need to talk to each another. As many companies are using a myriad of marketing technologies, the amount of data being collected is growing exponentially.

However, there is limited, or no, integration among the systems resulting in data silos that in turn negates the required collaboration of data to form a truly holistic view of the customer.

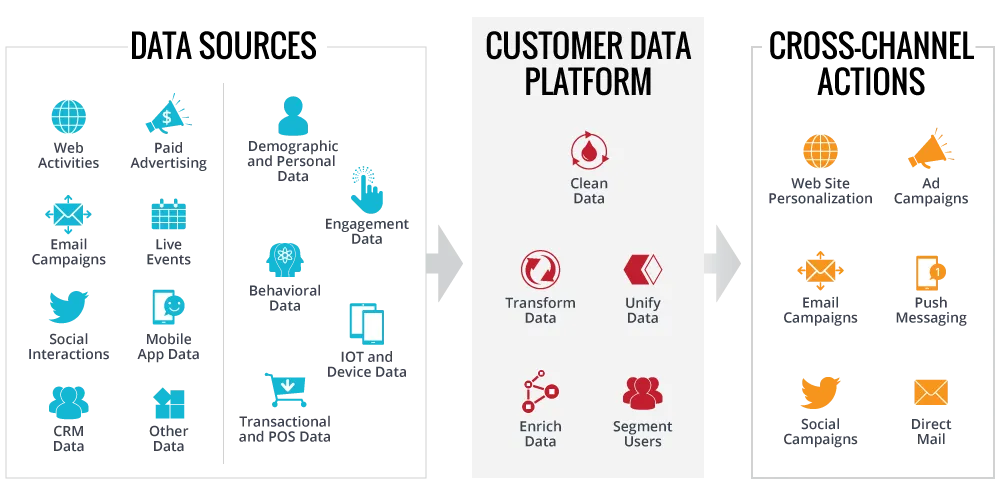

What a CDP does, is to take or collect data from a wide variety of online and offline systems and create a unified, cleansed database. Then, by using machine learning and AI, it creates coherent customer profiles that can be used to orchestrate highly relevant and personalised messaging to customers.

The diagram below gives a succinct overview of the main components involved (credit: HGS digital).

CDP scenarios for Insurers

So, by now you should have a good grasp of what a CDP is, how it functions at a high level and probably how it could benefit insurance companies.

For further relevance, let us look at some scenarios that are typical to Insurers and how a CDP offers a seamless way to interact with potential customers and existing policy holders alike.

1. Product exploration

A prospective customer uses a search engine to look for "Car Insurance". They click on your paid search advert and is directed to your website, browses for a while, but then drops off. The CDP automatically creates a new "single customer view" if there is not one already and associates the steps they have taken.

Later, this prospect continues to browse the internet and is presented with a push notification based on their previous activities and intent.

2. Quote-based personalisation

Someone visits a health insurance website and goes through the steps of getting a quote, fills in their details but does not complete the transaction.

The health insurance provider can then target this person with personalised quote-level messages, addressing the user by name across different channels such as on-site notification, social media, email, and SMS.

3. Policy documentation reminder

A user has applied and paid for a new insurance plan but has failed to submit the requisite documentation.

The CDP triggers a personalised reminder about submitting the missing documents. This can be done via an email, SMS, a browser push notification, or a homepage banner.

4. Call centre follow up

A user receives a call from the call centre regarding a life insurance plan. The user shows interest but does not finalise the plan.

They later receives an SMS with a customised offer as discussed with the telesales agent.

5. Returning website user – personalisation and upsell

An existing customer visits their insurance brand's website. As the site loads, they receive a message personalised with their first name.

They are also presented with other insurance product offers relevant to their profile in the CDP.

In conclusion

We have seen how a CDP gives you detailed 360° customer profiles along with the ability to leverage data-driven personalisation which ultimately should increase revenue and provide an enriched customer experience.

For the insurance industry, a CDP offers a step-change in terms of offering a coherent "single view of the customer" and the ability to orchestrate highly personalised messaging that will chime with your customers.

We suggest that this capability is something insurers should explore further as the digital-first world now increasingly expects online relevance, tailored products, and meaningful engagement.

Want to learn more about how a CDP can add value to your organisation?

Annertech's consultants can help you with your CDP strategy and development.

Get in Touch